41 what are coupon payments

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to... Coupon Payments Definition | Law Insider Coupon Payments means coupon payments, the details of which will be specified in the applicable Pricing Supplement. Coupon Payments. - means the payments representing distributions of profits (or return of capital) in relation to the Trustee LP that the ABC Arrangement provides for the Scheme trustee to receive.

Coupon payments financial definition of Coupon payments Coupon payments are expressed as a percentage of the face value ( par) of a bond. For example, if one holds a bond worth $100,000 at 5% interest, the bondholder will receive $5,000 in coupon payments per year (or, more strictly, $2,500 every six months) until the bond matures or he/she sells the bond.

What are coupon payments

Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments. Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period... $20 Off - PayPal Coupon - November 2022 COUPON. $20 off Select PayPal Credit Orders at PayPal. Show coupon. Available until further notice. More Details. Deal. Seasonal Savings: Get 6 Months Special Financing on all Orders over $99 with PayPal Credit. Use by Dec 31, 2022. More Details.

What are coupon payments. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. UBS Declares Coupon Payments on 12 ETRACS Exchange Traded Notes CEFD and MVRL pay a variable monthly coupon, and MLPR and BDCX pay a variable quarterly coupon, each linked to 1.5 times the cash distributions, if any, on the respective underlying index ... Coupon Bond: Definition, How They Work, Example, and Use Today A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no... .If the coupon payments are NOT reinvested during the | Chegg.com Finance questions and answers. .If the coupon payments are NOT reinvested during the holding period of a bond then [l]the initial yield to maturity is greater than the realized yield. [ll]the nominal yield is greater than the initial yield to maturity. the initial current yield equals the initial yield to maturity.

What is a Coupon Payment? - Definition | Meaning | Example What is the definition of coupon payment? Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond. What is Coupon payment | Capital.com Content It's the annual interest payment made by the issuer of a bond to the bondholder until it reaches maturity. The coupon payment - or simply coupon is expressed as a percentage of the bond's value at the time it was issued. Where have you heard about coupon payment? The term coupon comes from once popular bearer bond certificates. Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period... What Is a Bond Coupon, and How Is It Calculated? - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to...

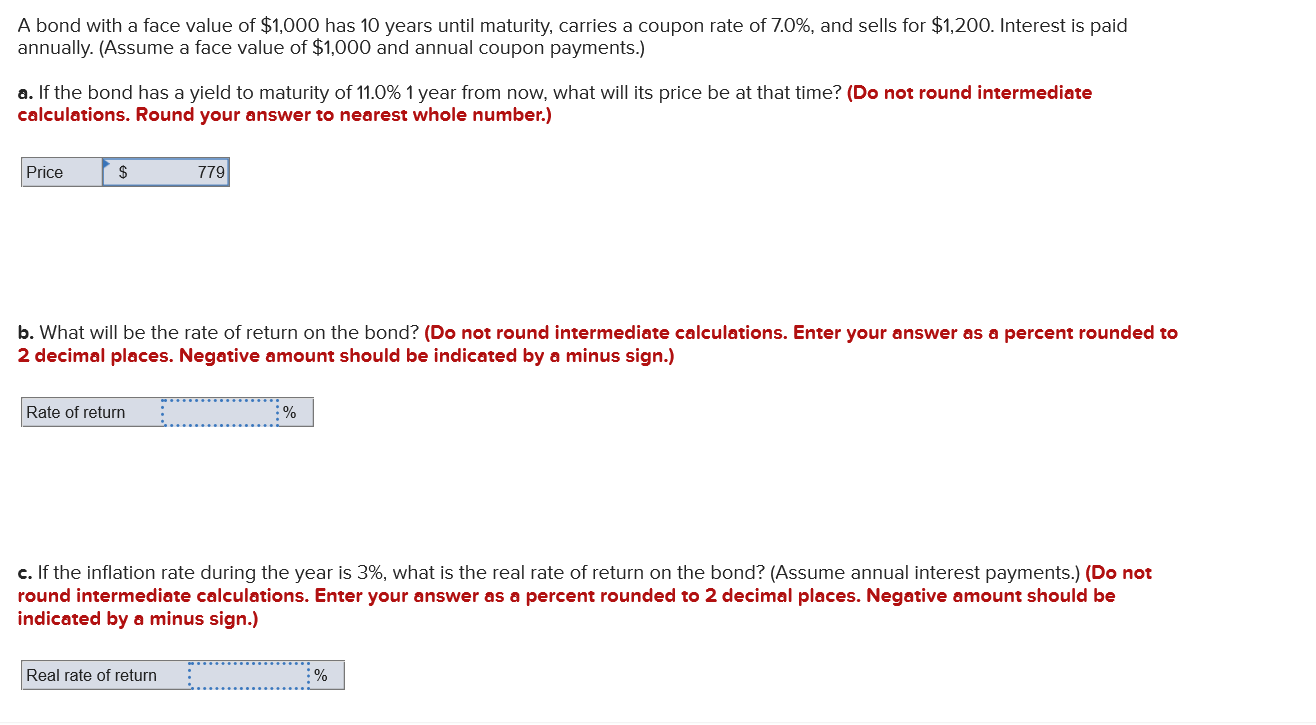

What is payment coupon? - KnowledgeBurrow.com The payment coupon is the perforated section at the bottom of the statement that you mail in with your payment. Simply complete the amount of your payment in the Total payment field and other amounts you are sending to be applied to your account, such as Additional principal or Additional late charge (if applicable). Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... You may receive less, and possibly significantly less, than the principal amount of your investment at maturity or upon repurchase or sale. Coupon payments on the ETNs will vary and could be... Solved A 2-year bond with par value $1,000 making annual | Chegg.com What will be the realized compound yield to maturity if the 1-year interest rate next year turns out to be (i) 7%, (ii) 10%, (iii) 13%? (Round your answers. Question: A 2-year bond with par value $1,000 making annual coupon payments of $116 is priced at $1,000. a. What is the yield to maturity of the bond? (Round your answer to 1 decimal place.) Coupon payments Definition | Nasdaq Coupon payments. A bond's interest payments. Most Popular Terms: Earnings per share (EPS) Beta; Market capitalization; Outstanding; Market value; Over-the-counter (OTC) Sexvigintillion;

Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... You may receive less, and possibly significantly less, than the principal amount of your investment at maturity or upon repurchase or sale. Coupon payments on the ETNs will vary and could be...

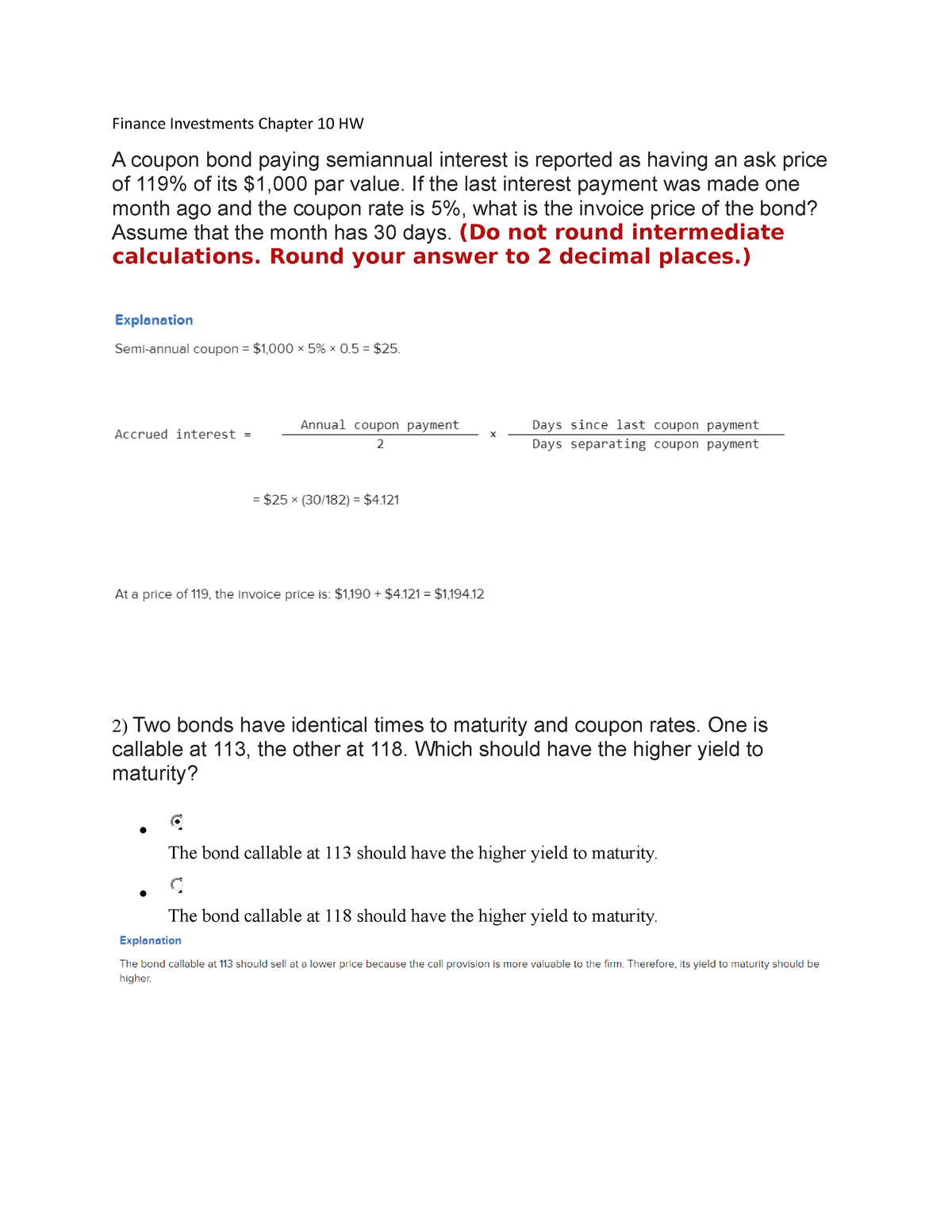

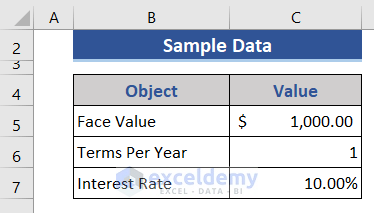

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment is .08 * 1000 or $80. [6] 2

Deferred Coupon Payments Definition | Law Insider Cite. Deferred Coupon Payments means accrued and unpaid coupon payments that have been deferred in accordance with Section 2.12, and additional coupons on such deferred accrued and unpaid coupon payments, to the extent permitted by applicable law, at a rate equal to the coupon rate calculated on the basis of a 360- day year of twelve 30-day ...

Coupon Payment | Investor.gov Coupon Payment The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value.

$20 Off - PayPal Coupon - November 2022 COUPON. $20 off Select PayPal Credit Orders at PayPal. Show coupon. Available until further notice. More Details. Deal. Seasonal Savings: Get 6 Months Special Financing on all Orders over $99 with PayPal Credit. Use by Dec 31, 2022. More Details.

Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period...

Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.

![PDF] Yield-to-Maturity and the Reinvestment of Coupon ...](https://d3i71xaburhd42.cloudfront.net/cd78b917effc5ad37eadf3dd6629e42e1a6f88f3/2-Figure1-1.png)

Post a Comment for "41 what are coupon payments"