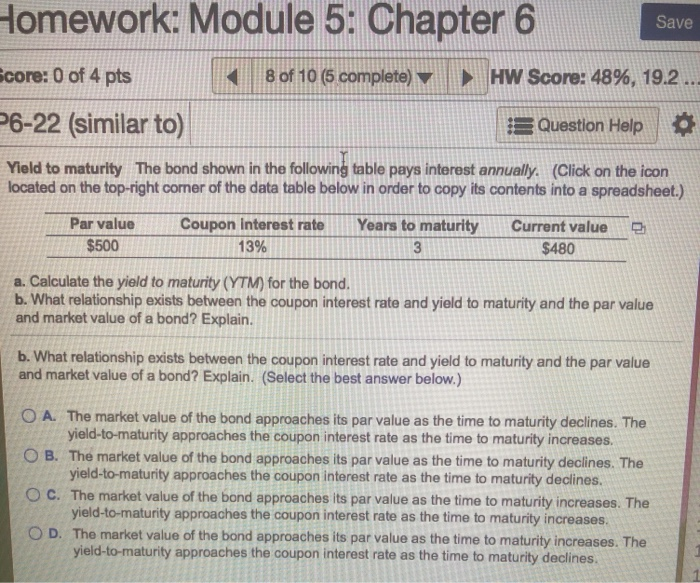

38 coupon vs interest rate

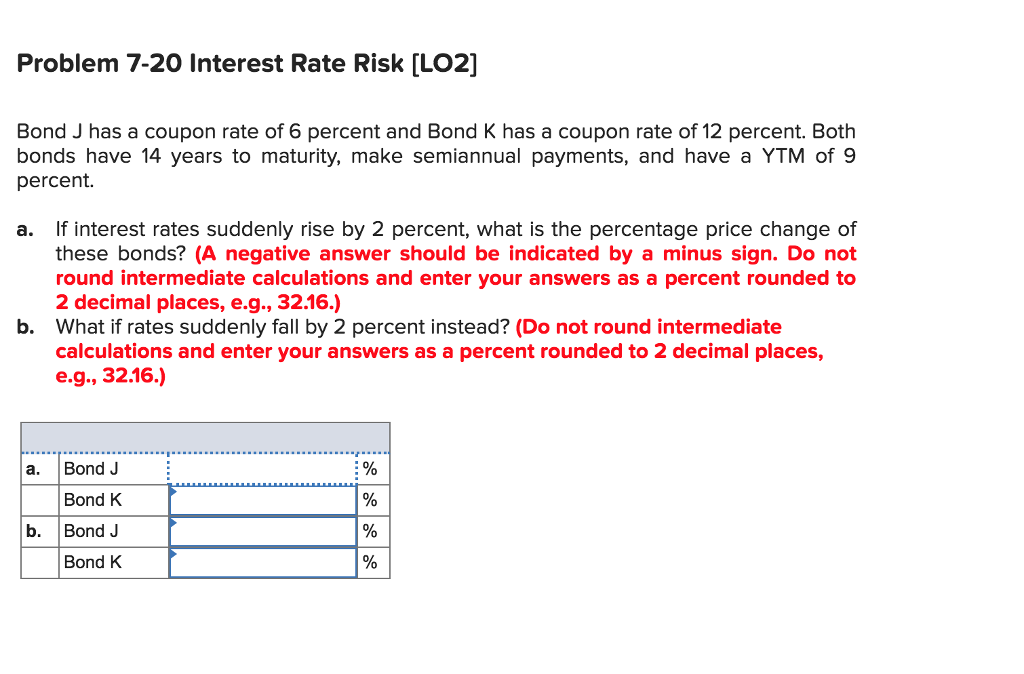

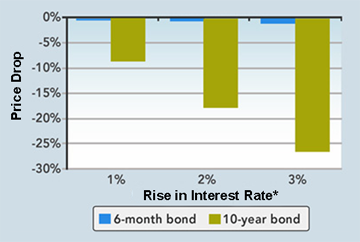

Bond yield vs coupon rate: Why is RBI trying to keep yield down? An increase in YTM indicates below normal coupon rate or that the interest rates are forcibly kept low, resulting in fall in market value of the bonds. Written by Amitava Chakrabarty Updated ... How are bond yields different from coupon rate? The coupons are fixed; no matter what price the bond trades for, the interest payments always equal Rs 40 per year. The coupon rate is often different from the yield. A bond's yield is more ...

APY vs Interest Rate: What Is the Difference [Guide for 2022] - Review42 When calculating the interest rate vs APY, you need to multiply by 100 and get to a percentage to find the interest rate. If you multiply 0.053660387 by 100, you find the interest rate equals 5.366% (if the APY is 5.5 %, and interest is compounded monthly).

Coupon vs interest rate

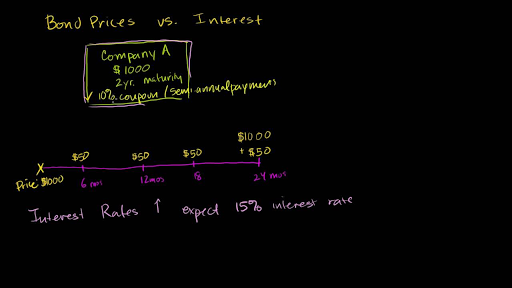

Coupon Rate Definition - Investopedia The coupon rate is the annual income an investor can expect to receive while holding a particular bond. It is fixed when the bond is issued and is calculated by dividing the sum of the annual... What is 'Coupon Rate' - The Economic Times Coupon rate is not the same as the rate of interest. An example can best illustrate the difference. Suppose you bought a bond of face value Rs 1,000 and the coupon rate is 10 per cent. Every year, you'll get Rs 100 (10 per cent of Rs 1,000), which boils down to an effective rate of interest of 10 per cent. What Is the Relationship Between Bond Prices & Interest Rates? Coupon Rate — The interest rate of the bond, as a percent of the principle. A $1,000 bond with a coupon rate of 5% pays $50 in interest each year. Coupon Dates — The prearranged dates when the interest will be paid to investors. This can be at any time, but the most popular interval is semiannual.

Coupon vs interest rate. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Difference Between Coupon Rate and Required Return Main Differences Between Coupon Rate and Required Return, Coupon Rate is the periodical price that the buyer receives until the bond matures. Required Return is the amount paid for the investor to own the risks. The coupon rate is calculated using the formula Coupon rate = ( Total annual payment/par value of bond) * 100. Difference Between Coupon Rate and Interest Rate What is the difference between Coupon Rate and Interest Rate? • Coupon Rate is the yield of a fixed income security. Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending. Interest Rates - Frequently Asked Questions | U.S. Department of the ... Yields on all Treasury securities are based on actual day counts on a 365- or 366-day year basis, not a 30/360 basis, and the yield curve is based on securities that pay semiannual interest. All yield curve rates are considered "bond-equivalent" yields. Does the par yield curve assume semiannual interest payments or is it a zero-coupon curve?

Individual - TIPS: Rates & Terms - TreasuryDirect TIPS are issued in terms of 5, 10, and 30 years, and are offered in multiples of $100. The price and interest rate of a TIPS are determined at auction. The price may be greater than, less than, or equal to the TIPS' par amount. (See rates in recent auctions .) The price of a fixed rate security depends on its yield to maturity and the interest ... Coupon Rate vs Interest Rate - WallStreetMojo The key differences between Coupon Rate vs. Interest Rate are as follows -, The coupon rate is calculated on the face value of the bond, , which is being invested. The interest rate is calculated considering the basis of the riskiness of lending the amount to the borrower. The coupon rate is decided by the issuer of the bonds to the purchaser. Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements. Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held...

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually. Key Takeaways, Coupon rates are the yields... Bond Stated Interest Rate Vs. Market Rate | Pocketsense A coupon rate can best be described as the sum, or yield, paid on the face value of the bond annual over its lifetime. So, for example, if you had a 10-year bond with a value of $1,000 and a coupon rate of 10 percent, the purchaser of the bond would receive $100 each year in interest. This differs from the market interest rate of a bond, which ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate. Investors use the phrase "coupon rate" for two reasons. Coupon Rate Formula & Calculation | Coupon Rate vs. Interest Rate ... When interest rate is higher than the coupon rate: In this case, the market price of the bond drops. For instance, if the interest rate is 10% and the coupon rate is 6%, investors would not like to...

Reinvestment Risk (Coupon) vs. Interest Rate Risk (Zero-Coupon) You avoided that reinvestment risk but you are loaded up on interest rate risk (high duration). For any given voliatility of interest rate changes, your bond price will fluctuate more than mine as it has higher duration. I sweat the coupon reinvestment but you have more of a valuation roller coaster ride. Hope that helps... David,

CD Rate and APY: What's the Difference? | Fox Business In today's low interest-rate environment, the difference between the APY and the nominal rate is only a few hundredths of a percentage point. Using Bankrate's tool for comparing CD rates, in...

CD Account Interest Monthly vs. Annually | Pocketsense To figure out how much additional interest a CD that compounds interest monthly will earn each year versus a CD that compounds interest annually, you need to know the interest rate being offered. First, divide the interest rate by 100 to find the interest rate as a decimal. Next, divide it by 12 to calculate the monthly interest rate.

Coupon Rate Calculator | Bond Coupon Does interest rate affects the coupon rates? For plain-vanilla bonds, no, the coupon rates are set when the bonds are formed. It is stated in the bond indenture and does not change with interest rates. However, if you are investing in inflation-linked bonds, the coupon rates can change to match the inflation. Wei Bin Loo,

Understanding Interest Rate and APY - Deposit Accounts Interest rate. The "interest rate is the simplest term to understand. It simply means the amount of interest that will be paid on an investment you make; or the amount charged on a loan per year. It may seem that this is all you need to know and when looking at deposit products that pay simple interest, it pretty much is.

What is difference between coupon rate and interest rate? The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 basis points or 0.5%. That would push up all interest rates.

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA Coupon Rate or Nominal Yield = Annual Payments / Face Value of the Bond, Current Yield = Annual Payments / Market Value of the Bond, Zero-Coupon Bonds are the only bond in which no interim payments occur except at maturity along with its face value. Bond's price is calculated by considering several other factors, including: Bond's face value,

Coupon Definition & Meaning - Merriam-Webster The meaning of COUPON is a statement of due interest to be cut from a bearer bond when payable and presented for payment; also : the interest rate of a coupon. How to use coupon in a sentence.

Important Differences Between Coupon and Yield to Maturity - The Balance Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Difference Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on. The coupon rate follows a formula to calculate the rate.

What Is the Relationship Between Bond Prices & Interest Rates? Coupon Rate — The interest rate of the bond, as a percent of the principle. A $1,000 bond with a coupon rate of 5% pays $50 in interest each year. Coupon Dates — The prearranged dates when the interest will be paid to investors. This can be at any time, but the most popular interval is semiannual.

What is 'Coupon Rate' - The Economic Times Coupon rate is not the same as the rate of interest. An example can best illustrate the difference. Suppose you bought a bond of face value Rs 1,000 and the coupon rate is 10 per cent. Every year, you'll get Rs 100 (10 per cent of Rs 1,000), which boils down to an effective rate of interest of 10 per cent.

Coupon Rate Definition - Investopedia The coupon rate is the annual income an investor can expect to receive while holding a particular bond. It is fixed when the bond is issued and is calculated by dividing the sum of the annual...

![Difference Between Coupon Rate and Interest Rate [Updated 2022]](https://askanydifference.com/wp-content/uploads/2021/04/Coupon-Rate-vs-Interest-Rate.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "38 coupon vs interest rate"