43 fixed coupon note term sheet

Convertible bond - Wikipedia In finance, a convertible bond or convertible note or convertible debt (or a convertible debenture if it has a maturity of greater than 10 years) is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. It is a hybrid security with debt- and equity-like features. It originated in the mid-19th century, and was ... VanEck Investment Grade Floating Rate ETF This fund can also be useful for investors looking to fine tune fixed income exposure in certain environments. Whereas most bond ETFs invest exclusively in debt that pays a fixed coupon over the life of the note, this ETF holds debt that adjusts its coupon payment based on a reference rate. As a result, there is minimal interest rate risk ...

Peruvian Restaurant Coupon Up to 90% Off | JCPenney Portrait Studio Coupons May 2022 Save up to 90% on photo session, prints, or digital image packages at JCPenney Portrait Studio. Click "See Groupon" for more information. Get Deal 43 used 40% Off Coupon Code 40% Off With JCPenney Portraits Coupon Code This limited-time promo code will score you 40% off most purchases.

Fixed coupon note term sheet

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. equity linked note term sheet - shippin.in equity linked note term sheet The amount of the payment is variable and depends on how the market that the Note is linked to performs over the term of the Note (e.g. This term sheet is for discussion purposes only and is not binding on Company or the Investors (as defined below). HOW YOUR MARKET LINKED GAIN OR LOSS IS CALCULATED 1. Coupon Toucan Food Of Your Mood Coupon Code Food of Your Mood $10 off Welcome! Get $10 off your first order of $15+ on delivery.com. Use code $5 OFF Food of Your Mood Restaurant Coupons & Promo … $5 off Want to know if Food of Your Mood Restaurant offers specials like 20% off food, specials during holidays, or coupon codes?

Fixed coupon note term sheet. iShares Floating Rate Bond ETF - ETFdb.com FA Report PDF. This ETF offers exposure to floating rate debt, an asset class that may be appealing to investors looking to minimize interest rate risk (perhaps related to concerns about rising rates). Most bond ETFs offer exposure to securities that pay a fixed coupon over the life of the note, and as such are impacted when interest rates rise ... Why Structured Notes Might Not Be Right for You - Investopedia The 24% cap means the most you can make on the note is 24%, regardless of how high the index goes. On the downside, if the price index was down -10%, the note would be flat, returning 100% of the... Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Range Accrual Definition - Investopedia For example, say an investor holds a 3% coupon, one-year note with a monthly payout. The index base for the security is the price of crude oil trading in New York, with a range between...

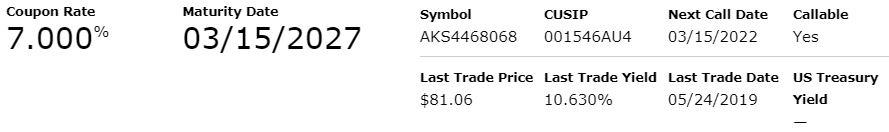

Structured securities prospectuses - Barclays Up to EUR 45,000,000 Notes linked to a "Worst-of" Equity Basket due 27 May 2020 (Series: NX000169335) Final Notice (PDF 82KB) Drawdown Prospectus (PDF 385KB) Spanish Summary Translation (PDF 164 KB) 27/03/2015 XS1167120168: EUR 35,000,000 Fixed to Quarterly Decompounded Floating Rate Notes due 18 March 2030 Series: NX000167499 Coupon Rate - Learn How Coupon Rate Affects Bond Pricing until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Blogger - Macro Net Coupon 15% off figs discount codes, coupons 2022 - retailmenot.com figs discount codes, coupons, & promo codes submit a coupon delivery free shipping 15% off code 15% off womenswear + free shipping on $50+ verified 2 days ago added by mik19 show coupon code see details sale sale give $20, get $20! 12 uses today see details 15% off code 15% off your … Definition Equity-Linked Note (ELN) - Investopedia An equity-linked note (ELN) is an investment product that combines a fixed-income investment with additional potential returns that are tied to the performance of equities. Equity-linked notes are...

Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp) Pricing Term Sheet. This term sheet supplements the information set forth under "Description of the Notes" in the Prospectus Supplement, subject to completion, dated April 19, 2022 to the Prospectus dated April 11, 2022 (the "Preliminary Prospectus Supplement"). 4.586%, payable semiannually in arrears during the Fixed Rate Period. Fixed Assets: Definition, Types, Financial Impact - Insider A fixed asset is an accounting term that's used to distinguish between assets that will be quickly used up (i.e., current assets) and assets that will provide value for a longer period. A company's... Coupon Rate Definition - Investopedia The coupon rate is the annual income an investor can expect to receive while holding a particular bond. It is fixed when the bond is issued and is calculated by dividing the sum of the annual... 10-Year T-Note Options Quotes - CME Group Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis trading, adjusting portfolio duration, curve trading, expressing directional ...

Stock Market | FinancialContent Business Page ABS note amount of $445 million ($423 million, net of a certain fees and approximately $15 million in restricted cash interest reserve) Fixed coupon of 5.78% (notes issued at par) A rating of BBB (Fitch Ratings, Inc.) ... strong investor demand for seasoned-issuers like Diversified and our desire to transition long-term assets from our RBL into ...

Equity-Linked Notes (ELN) Best Practices - Confluence Fixed Coupon and Initial Equity Price can be sourced from the term sheet or trade ticket. Annualized Coupon Rate = Fixed Coupon Rate * Initial Equity Price Input the calculated variable rate using Add Variable Rate. Effective Date (1109): populate with Dated Date from the SMF

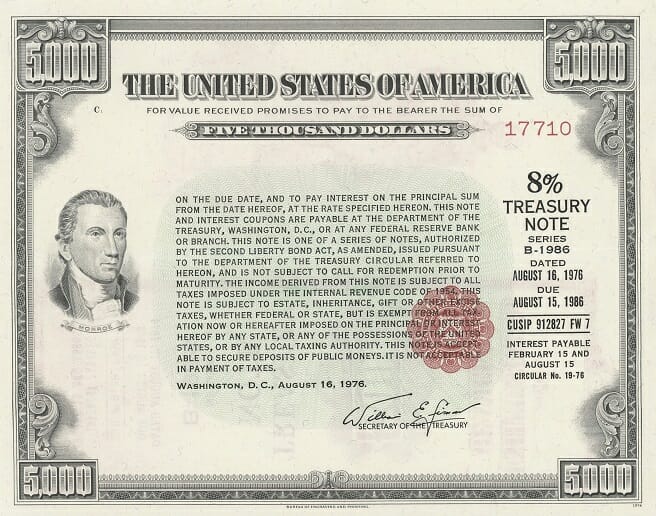

Treasury Note Definition - Investopedia A Treasury note is a U.S. government debt security with a fixed interest rate and maturity between two and 10 years. Treasury notes are available either via competitive bids, in which an investor...

Premium Coupons According to our data, they have published a new coupon on 03 Apr, 2022. Buffalo Jackson Coupons 2022 | 10% off - 60% off Buffalo Jackson Coupon ... Buffalo Jackson Coupon Codes 2022 All ( 51 ) Voucher Codes ( 1 ) Deals ( 50 ) $45 New $45 Off Any Order Get Code > more $45 Off Any Order is valid only for a limited time. Post a Comment Read more

June 2022 30 Year Fixed | Fannie Mae june 2022 30 year fixed mandatory delivery commitment mandatory delivery commitment 30-year fixed rate a / a. date: time: 10-day: 30-day: 60-day: 90-day: 06/01/2022: 08:15

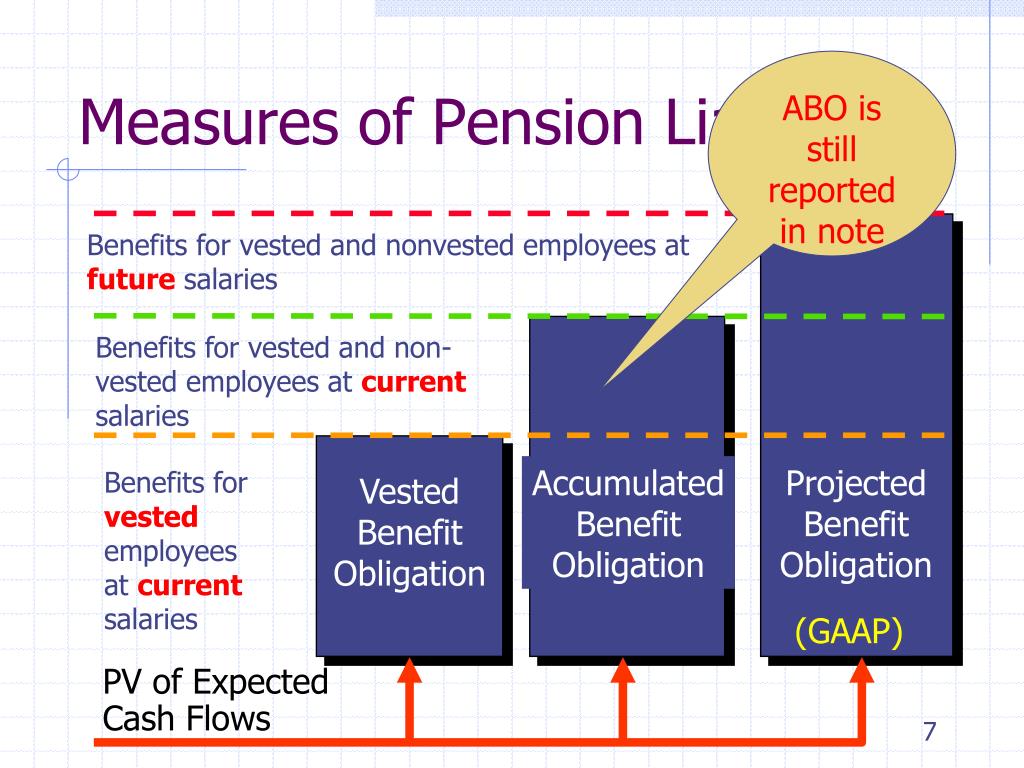

CFA Level 1 Fixed Income: Our Cheat Sheet - 300Hours This cheat sheet is basically a CFA Level 1 Fixed Income notes and formula sheet. ... - Usually higher for discount bonds, except long term, low coupon bonds, where it is possible to have a lower duration on that vs. a comparable shorter term bond. Money duration.

equity linked note term sheet - henryfilms.com As you approach potential investors, the term sheet will be a critical part of your seed. Product factsheets (Professional Investor Clients Only) Bond Fact Sheet. The initial estimated value of the notes as of the pricing date is expected to be between $9.102 and $9.383 per unit, which is less than the public offering price listed below.

Preview Coupons 35% off kohl's promo codes, coupons, & discounts | may 2022 in kohl's coupons 20% off expired get extra 25% off purchase take up to 20% off with coupon e25 show coupon code last user saved $23.63 promo expired free standard when you spend over $35 buy clothing, shoes, homeware, kitchenware, toys and more at kohls.com and get free standard …

Nashville Business Coupons International flights offers, deals, discounts, coupons - Cleartrip Get up to Rs. 25,000 off on International Flights! Use Coupon Code : INTFLY. Know More. Expires in 1 day 14 hours. Offers May 2022 Flat 70% Today Promo Codes - The Hindu Show Coupon Code. ... express black friday coupon codes; fixed coupon note term sheet; flexible industrial ...

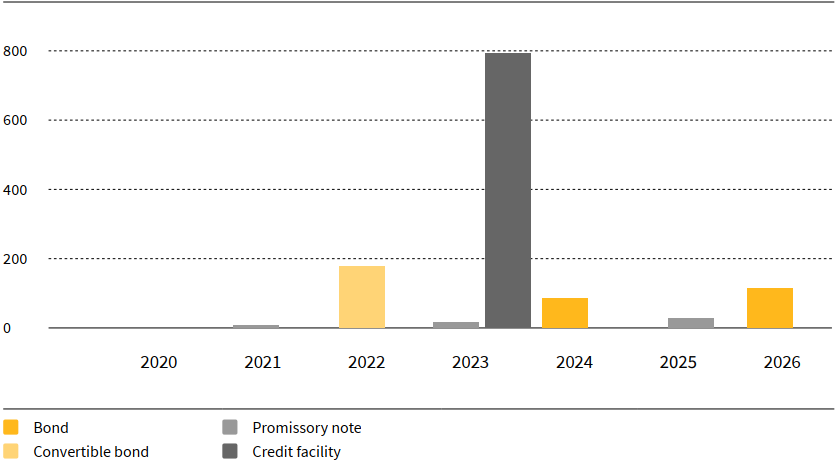

National Bank - Structured Solutions Group NBC Fixed Coupon Note Securities (Maturity-Monitored Barrier) ... Index Fact Sheet: Link. Dates Issue Date: 19-Mar-2021 Maturity date: 21-Sep-2026 Note term: 5.5 years Valuation Date: 14-Sep-2026. ETC Schedule; Highlights. 5.5-year term. Linked to the Solactive Canada Bank 30 AR Index. Guaranteed Coupon Payment: $4.00 p.a. paid semi-annually.

Coupon Toucan Food Of Your Mood Coupon Code Food of Your Mood $10 off Welcome! Get $10 off your first order of $15+ on delivery.com. Use code $5 OFF Food of Your Mood Restaurant Coupons & Promo … $5 off Want to know if Food of Your Mood Restaurant offers specials like 20% off food, specials during holidays, or coupon codes?

equity linked note term sheet - shippin.in equity linked note term sheet The amount of the payment is variable and depends on how the market that the Note is linked to performs over the term of the Note (e.g. This term sheet is for discussion purposes only and is not binding on Company or the Investors (as defined below). HOW YOUR MARKET LINKED GAIN OR LOSS IS CALCULATED 1.

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

Post a Comment for "43 fixed coupon note term sheet"